iowa capital gains tax farmland

Iowa capital gains on farmland iowa capital gains tax 2020 iowa capital gain exclusion iowa capital gains tax calculator. Farmers will be able to take advantage of the retirement income exemption if they qualify under the written rules.

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

If a property is held beyond a year capital gains are taxed at a rate of 15 or 20 in addition to.

. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical. How Much Is Capital Gains Tax In Iowa. Should the Department request it the information on the Capital.

Capital gains is calculated based on the net sale proceeds minus the owners basis in a property. - Law info 4 days ago. Some or all net capital gain may be.

The tax is owed on the amount that the property increased in value since it. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Published on May 29 2020 by Curtis Buono.

Iowa has a unique state tax break for a limited set of capital gains. - Law info 3 days ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Total Iowa capital gains taxes on all land sales in the state amounted to only 10 million dollars And so a very minor increase in value-added agriculture would increase total tax revenues. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet. We have worked with many agricultural landowners who are reluctant to sell long-held farms due to potentially massive.

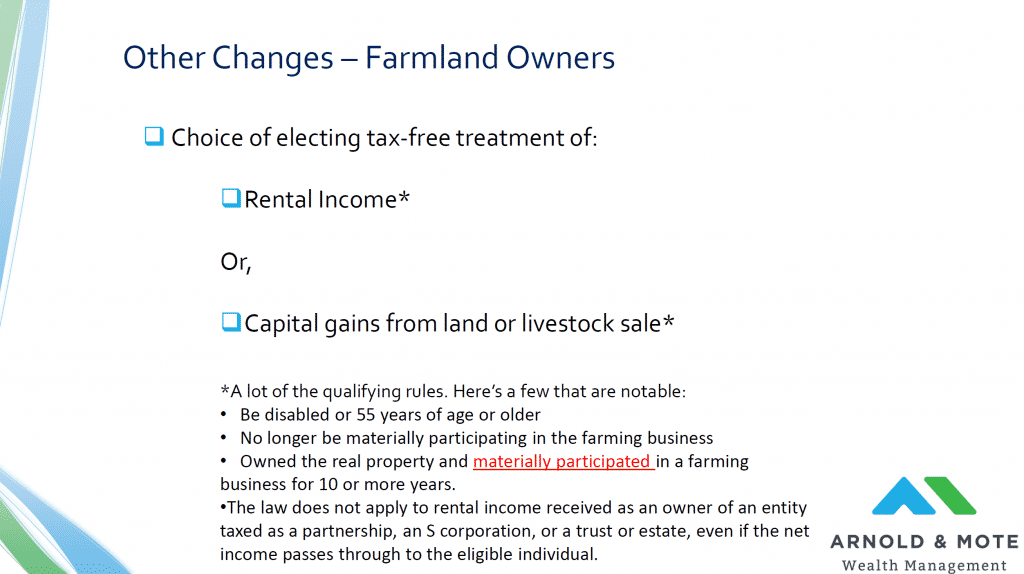

Capital gains taxes are due when farm or ranch land buildings breeding livestock and timber are sold. At the 22 income tax bracket the federal capital gain tax rate is 15. The Legislative Services Agency estimated the farm capital gains tax exemption will cost the state an estimated 72 million in fiscal year 2024.

When a landowner dies the basis is automatically reset to the current fair. Kim Reynolds signed a 39 flat tax on March 1. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state.

How Much Is Capital Gains Tax In Iowa. An estimate on retirement. However the actual rates are lower because iowa has a unique deduction for federal income taxes from.

The document has moved here. Iowa is a somewhat different story.

Farmland Market Outlook For 2022 From An Iowa Auctioneer

Capital Gains Tax Iowa Landowner Options

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

The Ultimate Guide To Selling Farmland Think Realty A Real Estate Of Mind

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Biden Tax Plan Would Sharply Limit Farmers Like Kind Exchanges 2021 05 11 Agri Pulse Communications Inc

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

What Property Qualifies For 1031 Exchange Cla Cliftonlarsonallen

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Missouri Independent

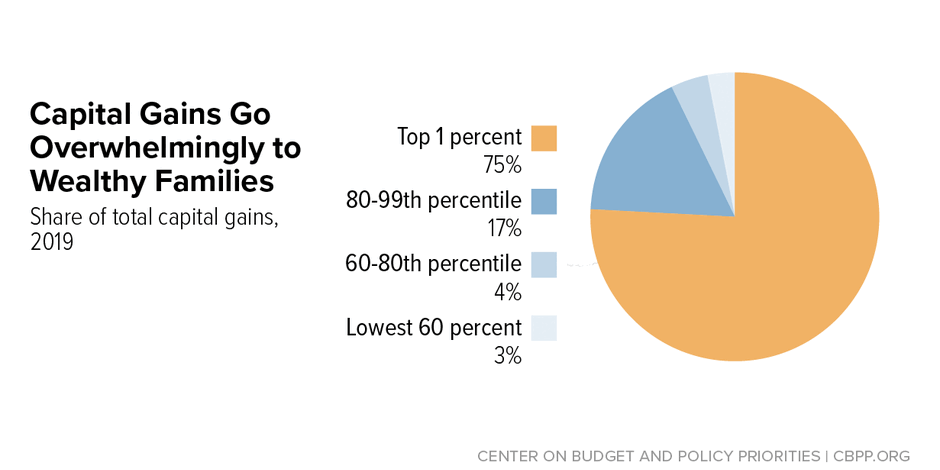

State Taxes On Capital Gains Center On Budget And Policy Priorities

2021 Capital Gains Tax Rates By State

Capital Gains Tax Iowa Landowner Options

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

When Do You Need A Farmland Appraisal Iowa Land Company Blog